Eurosystem staff macroeconomic projections for the euro area, December 2024

The euro area economy is set to continue its gradual recovery over the coming years, amid significant geopolitical and policy uncertainty. Although growth resumed at a moderate pace in the course of 2024, recent indicators suggest a weakening of growth in the short term, with ongoing subdued consumer confidence and high uncertainty likely to reinforce households’ saving incentives. Nevertheless, the conditions are in place for economic growth to strengthen again. In particular, rising real wages and employment, in a context of robust labour markets, are expected to support a recovery in which consumption remains one of the main drivers. Domestic demand should also be bolstered by an easing of financing conditions, in line with market expectations of the future path of interest rates. Although surrounded by high uncertainty, fiscal policies are assumed to be on a consolidation path overall. Nevertheless, funds from the Next Generation EU (NGEU) programme should support growth until the expiry of the programme in 2027. Under the baseline assumption that the trade policies of Europe’s key trading partners remain unchanged, foreign demand is expected to strengthen and support euro area exports. As a result, net trade is expected to make a broadly neutral contribution to GDP growth, despite existing competitiveness challenges. The unemployment rate is set to decline further to historically low levels. As some of the cyclical factors that have recently reduced productivity start to unwind, productivity is expected to pick up over the projection horizon, although structural challenges remain. Overall, annual average real GDP growth is projected to be 0.7% in 2024, 1.1% in 2025 and 1.4% in 2026, before moderating to 1.3% in 2027. Compared with the September 2024 ECB staff macroeconomic projections, the outlook for GDP growth has been revised down mainly owing to revisions to data on investment in the first half of 2024, expectations of weaker export growth in 2025, and a small downward revision to the projected expansion of domestic demand in 2026.[1]

Headline HICP inflation is projected to rise in late 2024, before declining to hover around the ECB’s inflation target of 2% from the second quarter of 2025. Base effects in the energy component are expected to be the main driver of the temporary increase in inflation at the start of the projection horizon. Based on assumptions of declining oil and gas prices, energy inflation is likely to remain negative until the second half of 2025 and to stay subdued thereafter, except for an uptick in 2027 owing to the introduction of new climate change mitigation measures. Food inflation is projected to rise until mid-2025, driven mostly by resurging unprocessed food price dynamics, before declining to an average of 2.2% by 2027. HICP inflation excluding energy and food (HICPX) is expected to decline in early 2025 as the indirect effects of past energy price shocks fade, labour cost pressures recede and the lagged impacts from past monetary policy tightening continue to feed through to consumer prices. This decline is expected to be led by a decrease in services inflation – which has thus far been relatively persistent. Overall, HICPX inflation is expected to moderate from 2.9% in 2024 to 1.9% in 2027. Wage growth will initially remain elevated but will decline gradually as inflation compensation pressures fade. The moderation in the growth of compensation per employee, coupled with a recovery in productivity growth, is expected to lead to significantly slower growth in unit labour costs. As a result, domestic price pressures are projected to ease, with profit margins initially buffering the still high labour cost pressures but recovering over the projection horizon. External price pressures should remain moderate overall. Compared with the September 2024 projections, the outlook for headline HICP inflation has been revised down marginally for 2024 and 2025, mainly owing to downward data surprises and lower oil and electricity price assumptions.

Table 1

Growth and inflation projections for the euro area

(annual percentage changes, revisions in percentage points)

|

|

December 2024 |

Revisions vs September 2024 |

||||||

|---|---|---|---|---|---|---|---|---|

2023 |

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

|

Real GDP |

0.5 |

0.7 |

1.1 |

1.4 |

1.3 |

-0.1 |

-0.2 |

-0.1 |

HICP |

5.4 |

2.4 |

2.1 |

1.9 |

2.1 |

-0.1 |

-0.1 |

0.0 |

HICP excluding energy and food |

4.9 |

2.9 |

2.3 |

1.9 |

1.9 |

0.0 |

0.0 |

-0.1 |

Notes: Real GDP figures refer to annual averages of seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. Revisions are calculated from rounded figures. Data are available for downloading, also at quarterly frequency, from the Macroeconomic Projection Database on the ECB’s website.

The global growth momentum has remained strong, even though increasing headwinds highlight the fragility of the global economic outlook.[2] Global growth increased slightly in the third quarter of this year, broadly in line with the September 2024 projections, as the pace of activity accelerated in China and real GDP growth in the United States was stronger than expected. Despite a broad-based weakness in manufacturing, incoming data suggest that global growth should remain robust in the fourth quarter of 2024, supported by strong economic data in the United States and fiscal support in China and the United Kingdom. However, geopolitical tensions in the Middle East, the war in Ukraine, lingering weakness in the Chinese real estate market and the possibility that the next US Administration will turn more inward-looking suggest that the global growth momentum remains fragile.

Table 2

The international environment

(annual percentage changes, revisions in percentage points)

|

December 2024 |

Revisions vs September 2024 |

||||||

|---|---|---|---|---|---|---|---|---|

2023 |

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

|

World real GDP (excluding the euro area) |

3.6 |

3.4 |

3.5 |

3.3 |

3.2 |

0.0 |

0.1 |

0.0 |

Global trade (excluding the euro area)1) |

0.9 |

4.0 |

3.6 |

3.3 |

3.2 |

0.9 |

0.2 |

0.0 |

Euro area foreign demand2) |

0.5 |

3.1 |

3.5 |

3.3 |

3.2 |

0.6 |

0.1 |

0.0 |

World CPI (excluding the euro area) |

5.0 |

4.2 |

3.2 |

2.8 |

2.6 |

0.0 |

-0.1 |

0.0 |

Export prices of competitors in national currency3) |

-1.0 |

2.2 |

1.7 |

2.3 |

2.1 |

-0.2 |

-0.5 |

-0.1 |

Note: Revisions are calculated from rounded figures.

1) Calculated as a weighted average of imports.

2) Calculated as a weighted average of imports of euro area trading partners.

3) Calculated as a weighted average of the export deflators of euro area trading partners.

Global growth is projected to remain moderate, declining slightly over the projection horizon. Global real GDP growth is projected to be 3.4% in 2024 and 3.5% in 2025, then to decrease to 3.3% in 2026 and 3.2% in 2027 (Table 2). Better prospects in the near term compared with the previous projections reflect strong economic data in the United States and China, as well as fiscal stimulus in both China (mostly to ease financial constraints of local governments) and the United Kingdom. The outcome of the US elections adds, however, significant uncertainty. While it is difficult at this stage to gauge the timing and degree of commitment related to statements made during the US presidential campaign, baseline projections for the United States already incorporate stricter immigration policies and the extension of personal and corporate income tax cuts introduced in 2017 and set to expire in 2025. The slight decrease in global growth later in the projection horizon is mainly due to expectations of slowing growth in China, reflecting unfavourable demographics, and some deceleration in the United States on account of lower immigration. In the United Kingdom, fiscal loosening is assumed to boost real GDP growth only temporarily, as future increases in corporate taxes are expected to weigh on private sector activity, resulting in lower growth in 2027.

After stronger than expected growth in the third quarter, global trade is projected to slow amid a less favourable composition of demand, with downside risks relating to increased trade protectionism and fragmentation. Global imports surprised on the upside in the third quarter, driven by a steep increase in US trade. Anecdotal evidence suggested that US firms had frontloaded imports ahead of possible trade restrictions and in anticipation of port strikes in October. While global trade remains inherently volatile, incoming data point to a decline in global import growth in the fourth quarter. The decline reflects weakness in the global manufacturing cycle and a normalisation of goods imports following previous frontloading. This is compounded by a less favourable composition of global demand, currently driven by the less trade-intensive services sector and public sector consumption. Over the rest of the projection horizon, trade is projected to grow in line with global activity as the composition of demand rebalances towards more trade-intensive items (e.g. manufacturing and investment). Global trade growth and euro area foreign demand have been revised up significantly for 2024 due to stronger data outturns, while remaining broadly similar to the September projections over the rest of the horizon. Euro area foreign demand growth is projected to rise from 3.1% in 2024 to 3.5% in 2025 – as trade rebounds in the euro area’s close trading partners – before coming down slightly to 3.3% in 2026 and 3.2% in 2027. The outlook, however, remains very uncertain. Further frontloading of imports, driven by expectations of trade restrictions, could strengthen trade in the short term. In the medium term, trade could be weaker amid ongoing geopolitical tensions and a possible increase in trade protectionism.

Global inflation is projected to remain on a declining path over the projection horizon, while growth in euro area competitors’ export prices has been revised down compared with the September projections. Global inflation remains on a gradual downward path, although services inflation remains persistent in advanced economies due to elevated wage growth. Global headline consumer price index (CPI) inflation is projected to decline from 4.2% in 2024 to 2.6% in 2027. Across advanced economies, the disinflation process is projected to continue, with headline inflation gradually converging towards central banks’ targets by 2026. Compared with the September projections, the global inflation profile is little changed. Euro area competitors’ export price growth, in national currencies and in annual terms, turned positive in 2024 as the impact of past declines in commodity prices and pipeline pressures dissipated. It should continue to hover around 2% over the projection horizon, broadly in line with its historical average. The downward revisions to competitors’ export price growth compared with the September projections for 2025 and 2026 mainly reflect the impact of lower oil prices and more entrenched producer price disinflation in China.

Box 1

Technical assumptions

Compared with the September 2024 projections, the main changes to the technical assumptions are lower oil and electricity prices but higher gas prices, a weaker exchange rate and lower interest rates. Oil and electricity price assumptions, based on futures prices, have been revised down somewhat, while those for gas have been revised up for 2025 and down slightly for 2026. Energy prices are assumed to decline over the projection horizon. Non-energy commodity prices have been revised up substantially for 2025 and down slightly for 2026. The euro exchange rate has depreciated by 3.0% against the US dollar and by 1.3% in nominal effective terms and is assumed to remain constant over the projection horizon. Based on market expectations, the assumptions for short-term interest rates have been revised down by 20-30 basis points over 2025-26, while those for long-term bond yields have been revised up slightly.

Table

Technical assumptions

|

December 2024 |

Revisions vs September 2024 |

|||||||

|---|---|---|---|---|---|---|---|---|---|

2023 |

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

||

Commodities: |

|||||||||

Oil price (USD/barrel) |

83.7 |

81.8 |

71.8 |

70.1 |

69.2 |

-1.6 |

-5.7 |

-4.2 |

|

Natural gas prices (EUR/MWh) |

40.6 |

34.3 |

42.9 |

34.9 |

29.3 |

0.3 |

4.3 |

-1.2 |

|

Wholesale electricity prices (EUR/MWh) |

103.5 |

76.7 |

89.9 |

79.5 |

73.6 |

-0.9 |

-3.6 |

-3.3 |

|

EU Emissions Trading System 1 (ETS1) allowances (EUR/tonne) |

83.7 |

65.4 |

69.6 |

71.8 |

74.0 |

-3.1 |

-5.6 |

-6.0 |

|

EU Emissions Trading System 2 (ETS2) allowances (EUR/tonne) |

- |

- |

- |

- |

59.0 |

- |

- |

- |

|

Non-energy commodity prices, in USD (annual percentage change) |

-12.5 |

8.9 |

5.8 |

-0.4 |

-1.7 |

1.6 |

4.5 |

-2.9 |

|

Exchange rates: |

|||||||||

USD/EUR exchange rate |

1.08 |

1.08 |

1.06 |

1.06 |

1.06 |

-0.3 |

-3.0 |

-3.0 |

|

Euro nominal effective exchange rate (EER41) (Q1 1999 = 100) |

121.8 |

124.2 |

123.5 |

123.5 |

123.5 |

-0.2 |

-1.3 |

-1.3 |

|

Financial assumptions: |

|||||||||

Three-month EURIBOR (percentage per annum) |

3.4 |

3.6 |

2.1 |

2.0 |

2.2 |

0.0 |

-0.3 |

-0.2 |

|

Ten-year government bond yields (percentage per annum) |

3.1 |

2.9 |

2.9 |

3.1 |

3.2 |

0.0 |

0.1 |

0.1 |

|

Notes: Revisions are expressed as percentages for levels and as percentage points for growth rates and percentages per annum. Revisions for growth rates and interest rates are calculated using figures rounded to one decimal place, while revisions reported as percentage changes are calculated using unrounded figures. The technical assumptions about euro area interest rates and commodity prices are based on market expectations, with a cut-off date of 20 November 2024. Oil prices refer to Brent crude oil spot and futures prices. Gas prices refer to the Dutch TTF gas spot and futures prices. Electricity prices refer to the average wholesale spot and futures price for the five largest euro area countries. The “synthetic” future price for ETS1 allowances (EUA) is derived as the end-of-month linearly interpolated value of the two nearest European Energy Exchange EUA futures. Monthly EUA futures prices are then averaged to produce an equivalent to annual frequency. In the absence of any trading of ETS2 allowances, the price assumptions were set by Eurosystem staff at the threshold price above which additional allowances will be released, with the price updated to 2027 prices (see Box 2 for further details). The paths of commodity prices are implied by futures markets in the ten working days ending on the cut-off date. Bilateral exchange rates are assumed to remain unchanged over the projection horizon at the average levels prevailing over the ten working days ending on the cut-off date. The assumptions for euro area ten-year nominal government bond yields are based on the average of countries’ ten-year bond yields, weighted by annual GDP figures. Where the necessary data exist, the country-specific ten-year nominal government bond yields are defined as the ten-year benchmark bond yields prolonged using the forward par yields derived, on the cut-off date, from the corresponding country-specific yield curves. For the other countries, the country-specific ten-year government bond yields are defined as the ten-year benchmark bond yield prolonged using a constant spread (observed on the cut-off date) over the technical euro area risk-free long-term interest rate assumption.

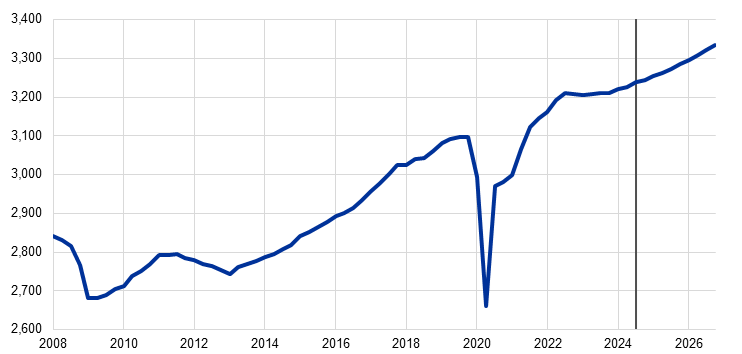

Having broadly stagnated throughout 2023, euro area economic activity increased in the course of 2024 (Chart 1). Quarter-on-quarter real GDP growth picked up from 0.2% in the second quarter of 2024 to 0.4% in the third quarter, supported by a rebound in domestic demand. Compared with the September 2024 projections, growth in the third quarter was 0.2 percentage points higher, while growth in the second quarter has been revised down. As a result, the overall level of economic activity in the third quarter was broadly in line with the September projections. This largely reflected offsetting surprises in investment and export dynamics, in the context of somewhat stronger consumption. Inventory building likely also contributed to growth in the third quarter. Across sectors, industrial activity is likely to have continued to decline in the third quarter, whereas activity in the services sector continued to grow.

Chart 1

Euro area real GDP

a) Real GDP growth

(quarter-on-quarter percentage changes, seasonally and working day-adjusted quarterly data)

b) Real GDP level

(chain-linked volumes (2020); EUR billions)

Notes: Historical data may differ from the latest Eurostat publications. The vertical line indicates the start of the current projection horizon. In panel a) the ranges shown around the central projections provide a measure of the degree of uncertainty and are symmetric by construction. They are based on past projection errors, after adjustment for outliers. The bands, from darkest to lightest, depict the 30%, 60% and 90% probabilities that the outcome of real GDP growth will fall within the respective intervals. For more information, see the box entitled “Illustrating the uncertainty surrounding the projections” in the March 2023 ECB staff macroeconomic projections for the euro area.

Incoming data suggest that euro area GDP growth will weaken somewhat in the short term, amid significant uncertainty. Survey-based indicators relevant for activity, such as the Purchasing Managers’ Index (PMI) and business and consumer confidence indicators from the European Commission, remain subdued. Most of them showed renewed declines in November. The incoming data point to persistent differences across sectors, with the manufacturing sector remaining very weak (the manufacturing output PMI for November was 45.1). At the same time, services activity has also moderated, as reflected in the drop in the services output PMI for November to below 50. Overall, economic activity is expected to grow by 0.2% in the fourth quarter of 2024, which is a slower rate than in the third quarter, as the one-off factors supporting growth in the summer (such as the Paris Olympics) have unwound, and given subdued confidence, high uncertainty and geopolitical tensions. With GDP growth projected to be 0.3% in the first quarter of 2025, the short-term outlook is broadly in line with the September projections.

Real GDP growth is expected to increase over the medium term, supported by a pick-up in consumption, strengthening foreign demand and the fading of the dampening effects of past monetary policy tightening (Table 3). The continued increase in households’ purchasing power, owing to resilient wage growth and declining inflation, should support private consumption growth. Household spending is projected to continue to underpin the recovery in the medium term (Chart 2, panel a), albeit to a slightly lesser extent than envisaged in the September projections. The overall resilient labour market and an assumed gradual recovery in consumer confidence should also support private consumption growth, notwithstanding continued strong incentives to save, including from the still high interest rates and tight credit standards. Investment is projected to gradually strengthen over the projection horizon, mostly reflecting the waning drag from past monetary policy tightening and support from increasing unit profits, the deployment of funds under the NGEU programme, and improving domestic and foreign demand. The latter is also expected to support export growth, despite the euro area’s competitiveness issues. While the fiscal stance is expected to have tightened in 2024, it should be broadly neutral in 2025-26. The fiscal stance is projected to tighten again towards the end of the horizon, contributing to a weakening of GDP growth in 2027 (see Section 4).

The impact of past monetary policy tightening on growth is estimated to fade over the projection horizon, helped by the ongoing decline in policy rates. The impact of the monetary policy measures taken between December 2021 and September 2023 continues to feed through to the real economy. However, most of the downward impact on growth should have already materialised. Following the policy rate cuts since June 2024, and on the basis of market expectations regarding the future path of interest rates at the time of the cut-off date for the projections (Box 1), the negative impact of past monetary policy tightening on economic growth is expected to fade in 2025. Although there is considerable uncertainty surrounding the magnitude and the timing of this negative impact, it should have run its course by 2026.

Chart 2

Euro area real GDP growth – decomposition into the main expenditure components

a) December 2024 projections |

b) Revisions vs September 2024 projections |

|---|---|

(annual percentage changes, percentage point contributions) |

(percentage points and percentage point contributions) |

|

|

Notes: Data are seasonally and working day-adjusted. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. The vertical line indicates the start of the current projection horizon. Revisions are calculated based on unrounded figures.

Table 3

Real GDP, trade and labour market projections

(annual percentage changes, unless otherwise indicated, revisions in percentage points)

|

December 2024 |

Revisions vs September 2024 |

||||||

|---|---|---|---|---|---|---|---|---|

2023 |

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

|

Real GDP |

0.5 |

0.7 |

1.1 |

1.4 |

1.3 |

-0.1 |

-0.2 |

-0.1 |

Private consumption |

0.8 |

0.9 |

1.3 |

1.3 |

1.2 |

0.1 |

-0.1 |

-0.2 |

Government consumption |

1.5 |

2.3 |

1.2 |

1.2 |

1.0 |

1.1 |

0.1 |

0.1 |

Investment |

1.8 |

-1.7 |

1.2 |

2.2 |

1.6 |

-1.2 |

0.0 |

0.1 |

Exports ¹⁾ |

-0.2 |

1.0 |

1.6 |

3.0 |

3.0 |

-0.2 |

-1.0 |

0.0 |

Imports ¹⁾ |

-0.7 |

0.1 |

2.3 |

3.1 |

2.9 |

0.1 |

-0.5 |

-0.2 |

Contribution to GDP from: |

||||||||

Domestic demand |

1.1 |

0.6 |

1.2 |

1.4 |

1.2 |

0.0 |

0.0 |

-0.1 |

Net exports |

0.3 |

0.5 |

-0.2 |

0.1 |

0.1 |

-0.2 |

-0.2 |

0.1 |

Inventory changes |

-0.9 |

-0.3 |

0.2 |

0.0 |

0.0 |

0.1 |

0.1 |

0.0 |

Real disposable income |

1.2 |

2.3 |

0.8 |

1.0 |

0.8 |

-0.5 |

0.0 |

0.2 |

Household saving ratio (% of disposable income) |

13.9 |

15.1 |

14.7 |

14.5 |

14.2 |

0.2 |

0.2 |

0.5 |

Employment ²⁾ |

1.4 |

0.8 |

0.4 |

0.6 |

0.5 |

0.0 |

0.0 |

0.2 |

Unemployment rate |

6.5 |

6.4 |

6.5 |

6.3 |

6.1 |

-0.1 |

0.0 |

-0.2 |

Current account (% of GDP) |

1.7 |

2.7 |

2.6 |

2.7 |

2.9 |

0.1 |

-0.1 |

0.0 |

Notes: Real GDP and components refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. Data are available for downloading, also at quarterly frequency, from the Macroeconomic Projection Database on the ECB’s website.1) This includes intra-euro area trade.

2) Persons employed.

Compared with the September 2024 projections, real GDP growth has been revised down over 2024-26 (Table 3 and Chart 2, panel b). The downward revisions for 2024-25 reflect weaker investment (mainly owing to revisions to data for the first half of 2024) and (net) exports in the short term, on account of ongoing competitiveness issues. This is partly offset in 2024 by much stronger government consumption. Private consumption growth has also been revised down for 2025-26, on account of a reassessment of the speed at which the saving ratio is expected to normalise from its current elevated levels.

Private consumption is still expected to be the main driver of GDP growth, supported by robust labour compensation growth on the back of rising wages and falling inflation. Private consumption growth is likely to have picked up strongly in the third quarter of 2024, despite the elevated household saving rate. Household spending should strengthen from an annual rate of increase of around 0.8-0.9% in 2023-24 to 1.3% in 2025-26, before edging down in 2027 to the pre-pandemic average of 1.2%. The recovery in private consumption reflects a gradual normalisation of the household saving rate and a rise in real disposable income, mainly owing to still strong wage growth and robust growth in non-labour income (in particular, income from self-employment and financial assets). Although real income growth is projected to be moderate in 2025-27, as the effects of the catch-up in real wages dissipate, private consumption growth should also benefit from a moderate decline in the saving ratio as consumer spending behaviour gradually normalises. The household saving rate is expected to remain elevated, reflecting still high, albeit declining, interest rates and still tight credit standards, and to decline gradually over the projection horizon, although at a slower pace than foreseen in the September 2024 projections. A recovery in consumer confidence, as well as consumption-smoothing behaviour – i.e. a delayed reaction of household spending to the increase in purchasing power – is also likely to contribute to the gradual decline in savings. Compared with the September 2024 projections, private consumption growth has been revised up by 0.1 percentage points for 2024, reflecting marginally stronger dynamics in the context of higher labour income growth, but has been revised down for 2025 and 2026 by 0.1 percentage points and 0.2 percentage points respectively, largely reflecting a higher saving rate, amid an expected slower normalisation of households’ spending behaviour.

Housing investment is projected to decline further in 2024 before slowly recovering in the course of 2025, as the negative effects of the tightening of financing conditions gradually ease and household real incomes continue to rise. Housing investment is likely to have continued its prolonged decline in the third quarter of 2024 and is also expected to fall in the coming quarters, albeit at a more moderate pace, reflecting persistent weakness in housing demand. Broadly in line with the improvement in expected demand for housing loans reported in the ECB’s latest euro area bank lending survey, housing investment is projected to recover from the second half of 2025, on the back of a gradual decline in mortgage lending rates and rising household incomes. Overall, following a further significant fall in 2024, with a negative carry-over effect on annual growth in 2025, housing investment is projected to increase on an annual basis in 2026 – for the first time since 2022.

Business investment is projected to grow at a modest pace over the projection horizon, amid geopolitical and economic policy uncertainty, but should be supported by a gradual improvement in domestic and foreign demand, robust unit profit growth and more favourable financing conditions. Euro area business investment contracted in the first half of 2024, on the back of high volatility owing to the activities of multinational companies in Ireland, weak demand and elevated uncertainty. Driven by expected stronger domestic and foreign demand, improving financing conditions and solid unit profit growth, investment is projected to increase in 2025. In 2026 and 2027 less drag from financing conditions, as well as crowding-in effects from the deployment of NGEU and private funds to spur the digital and green transitions, will also contribute to the recovery in investment.

After a decline in the third quarter of 2024, euro area export growth is expected to remain subdued before picking up next year, conditional on the assumption that global trade tariffs remain unchanged. Despite strong foreign demand, primarily owing to the frontloading of Christmas orders,[3] export growth was modest in the second quarter. With the global manufacturing cycle weakening and persistent competitiveness challenges for euro area exporters,[4] export growth decreased in the third quarter of the year, in line with negative signals from the latest survey indicators for manufacturing and services export orders. Exports are projected to recover at growth rates slightly below historical averages by the end of 2025, following a pick-up in foreign demand. Nonetheless, export market shares are projected to decline throughout the projection horizon. Imports are also expected to grow at a subdued rate somewhat below their long-term growth rate. Overall, after making a positive contribution in the second quarter of 2024, net trade made a negative contribution to growth in the third quarter and is expected to make a further negative contribution in the fourth quarter, before rebounding in the first half of 2025. The terms of trade are projected to improve over the projection horizon, given that the effect of the energy price shock has mostly worked through the economy. The current account balance is projected to reach almost 3% of GDP by the end of the projection horizon, which is slightly above the pre-pandemic average of 2.6%.

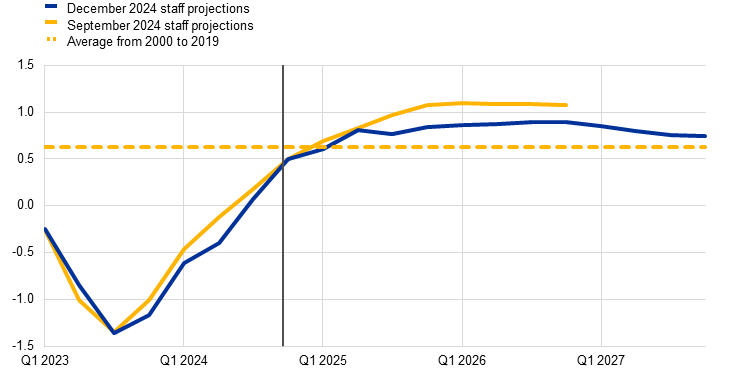

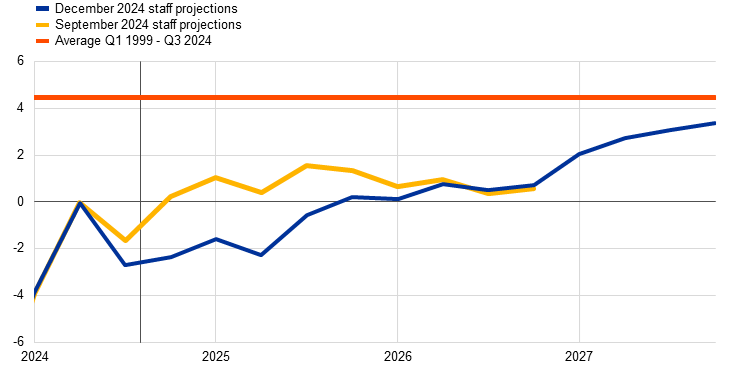

The labour market is set to remain resilient overall, although employment growth should slow in comparison with recent years. Employment grew modestly in the second and third quarters of 2024. It is projected to continue to increase at a relatively subdued quarterly growth rate of 0.1-0.2% over the projection horizon. In annual terms, employment growth is expected to have declined from 1.4% in 2023 to 0.8% in 2024 and is seen to fluctuate in a range of 0.4-0.6% in 2025-27 (an upward revision of 0.2 percentage points for 2026 compared with the September projections, partly on account of an upward revision to labour force growth). The pattern in employment (Chart 3) reflects the assumption that cyclical factors which have supported employment more than usual in the recent past, such as labour hoarding owing to significant labour shortages, as well as high profit growth, weak real wages and robust labour force growth, will gradually fade. Employment growth is projected to be subdued relative to GDP growth, nevertheless, it is still expected to return to the level consistent with its historical relation with GDP by mid-2027.[5]

Chart 3

Employment

(quarterly percentage changes)

Note: The vertical line indicates the start of the current projection horizon.

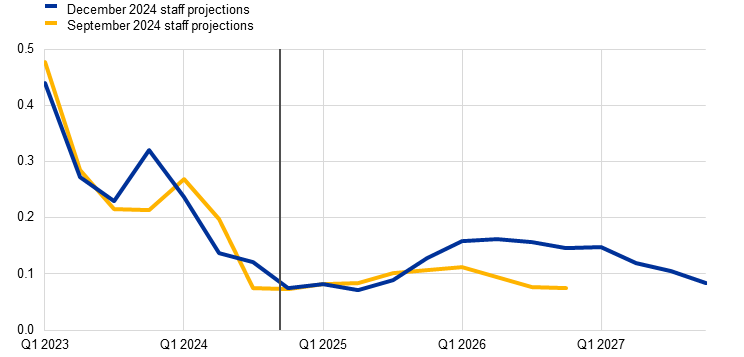

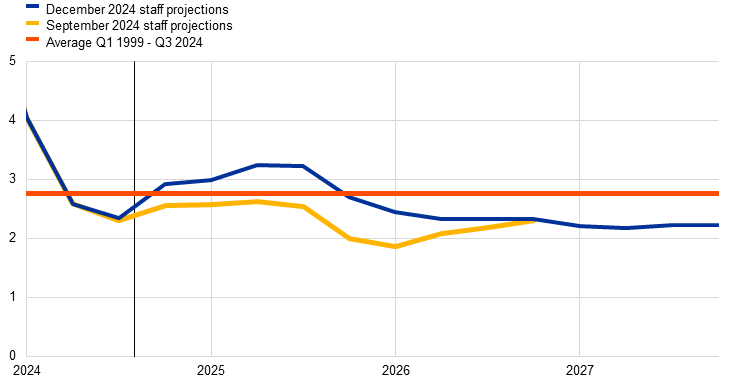

Labour productivity growth is expected to strengthen, but at a slower pace than foreseen in the September projections. With the cyclical adjustment of the economy over the projection horizon and a slowdown in employment growth, productivity is expected to pick up. Productivity growth (per person employed) surprised slightly on the upside in the third quarter of 2024, but has been revised down over the rest of the projection horizon, reflecting a slower cyclical recovery compared with the September projections (Chart 4). Productivity growth (per person employed) is now projected to rise from -0.1% in 2024 to 0.8% in 2025 and 0.9% in 2026, but to decline to 0.8% in 2027. This implies a more limited overshooting of the historical average growth rate of 0.6% per year over the period 2000-19, compared with the September projections, and should be seen against the annual average productivity growth rate of 0.3% between 2020 and 2023. The cyclical factors prevailing in the recent past that resulted in increased labour hoarding, weak real wages and robust labour force growth are projected to dissipate slowly, leading to a cyclical rebound in productivity growth. Productivity growth has been revised down to take into account structural factors which might limit the speed of the recovery in 2025 and 2026, such as the gradual reallocation of economic activity towards the services sector, transition costs towards the greening of the economy, a more lasting adverse impact of the energy price shock, a slower than expected adoption of highly innovative AI technologies, and demographic change.

Chart 4

Labour productivity growth per person employed

(annual percentage changes)

Notes: The vertical line indicates the start of the current projection horizon.

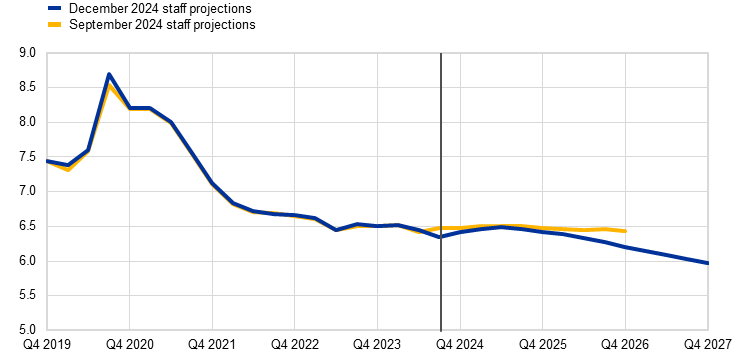

The unemployment rate is expected to decrease further to new historic lows (Chart 5). Despite a small uptick in early 2025, the unemployment rate is seen to resume its steady decline from the third quarter of 2025 and reach 6.1% in 2027. The path of the unemployment rate has been revised down slightly, by 0.1 percentage points on average, for 2024-25, partly owing to recent lower unemployment outturns, but also for 2026, owing to expected more resilient employment growth.

Chart 5

Unemployment rate

(percentage of the labour force)

Note: The vertical line indicates the start of the current projection horizon.

The euro area fiscal stance is estimated to have tightened significantly in 2024, by more than expected in the September 2024 projections, with the revisions being driven by non-discretionary factors (Table 4). The fiscal position in 2023 now indicates a slight loosening, in contrast to a neutral stance as estimated in the September projections, largely as a result of the 2024 benchmark national account revisions. Partly reflecting this somewhat looser position in 2023, the fiscal stance is estimated to have tightened significantly in 2024 on account of the withdrawal of a large part of the energy and inflation support measures, as well as sizeable non-discretionary factors. The latter mostly reflect strong revenue developments in some countries on account of composition effects, among other factors. The tightening of the fiscal stance in 2024 is stronger than estimated in the September projections on account of the above-mentioned non-discretionary revenue factors, which more than offset the slight loosening stemming from revisions to discretionary fiscal policy measures. Overall, however, the cumulative fiscal stance over the period 2020-24 remains very accommodative, reflecting the large amount of fiscal support granted since the outbreak of the pandemic.

The fiscal stance is projected to continue tightening, but only slightly over 2025-26 and more strongly in 2027 when the spending funded by NGEU grants is foreseen to be phased out – however the fiscal policy assumptions are surrounded by uncertainty.[6] For 2025, the discretionary fiscal policy measures incorporated into the baseline, which reflect the draft budgetary plans submitted by governments, indicate a somewhat larger degree of tightening than foreseen in the September projections. This is mostly due to increases in direct taxes and social security contributions resulting from new measures in several countries. This tightening is partly compensated by continued growth in public investment and higher fiscal transfers, as well as loosening non-discretionary factors.[7] In 2026 the fiscal stance is projected to tighten only slightly, implying a loosening compared with previous projections.[8] In 2027 the relatively strong tightening in the fiscal stance and in the discretionary fiscal policy measures primarily reflects assumed lower public investment and fiscal transfers related to the expiry of the NGEU grant funding. Government consumption growth is also assumed to slow more significantly (in real terms as of 2025, after a strong increase in 2024). Overall, the revisions to the discretionary fiscal policy measures compared with the September projections indicate a slight fiscal loosening over the projection horizon (amounting to close to 0.1 percentage points of GDP cumulatively over 2024-26), mainly on account of fiscal transfers, which more than compensate increases in taxes and social security contributions.

Table 4

Fiscal outlook for the euro area

(percentage of GDP; revisions in percentage points)

|

December 2024 |

Revisions vs |

|||||||

|---|---|---|---|---|---|---|---|---|---|

2023 |

2024 |

2025 |

2026 |

2027 |

2023 |

2024 |

2025 |

2026 |

|

Fiscal stance1) |

-0.2 |

0.9 |

0.1 |

0.1 |

0.6 |

-0.2 |

0.4 |

0.0 |

-0.2 |

General government budget balance |

-3.6 |

-3.2 |

-3.1 |

-3.0 |

-2.9 |

0.0 |

0.1 |

0.1 |

0.0 |

Structural budget balance2) |

-3.8 |

-3.1 |

-3.0 |

-3.0 |

-2.9 |

-0.1 |

0.1 |

0.2 |

0.0 |

General government gross debt |

87.4 |

87.8 |

88.3 |

88.7 |

88.6 |

-0.8 |

-0.7 |

-1.0 |

-1.1 |

1) The fiscal policy stance is measured as the change in the cyclically adjusted primary balance net of government support to the financial sector. The figures shown are also adjusted for grants under the Next Generation EU (NGEU) programme, which do not have an impact on the economy on the revenue side. A negative (positive) figure implies a loosening (tightening) of the fiscal stance.

2) Calculated as the government balance net of transitory effects of the economic cycle and measures classified under the European System of Central Banks definition as temporary.

The euro area budget balance is set to improve very gradually over the projection horizon and the debt ratio is seen to rise slightly and then broadly stabilise (Table 4). After a more substantial decline estimated for 2024, the euro area deficit is projected to change only slightly and to fall just below the reference value of 3% of GDP in 2027. This path mostly follows the projected improvement in the cyclically adjusted primary deficit, which is seen to outweigh the increase in interest payments. The cyclical component is expected to be small, worsening somewhat in 2024 and then remaining slightly negative until 2027. Compared with the September projections, the budget balance has been revised up slightly for 2024-25, but has remained unchanged for 2026. This mainly reflects the revisions to non-discretionary revenue factors and the consolidation measures described above. The euro area debt-to-GDP ratio is seen to increase somewhat in 2024-26 as the continuing (though declining) primary deficits and positive deficit-debt adjustments more than offset favourable interest rate-growth differentials. It is projected to stabilise towards the end of the horizon. Compared with the September projections, the debt ratio has been revised downwards over the entire horizon, mainly on account of the favourable (denominator) base effects in 2023 following the 2024 benchmark national accounts revisions.

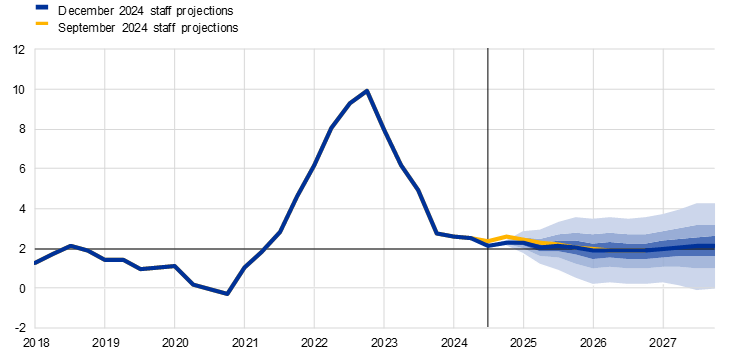

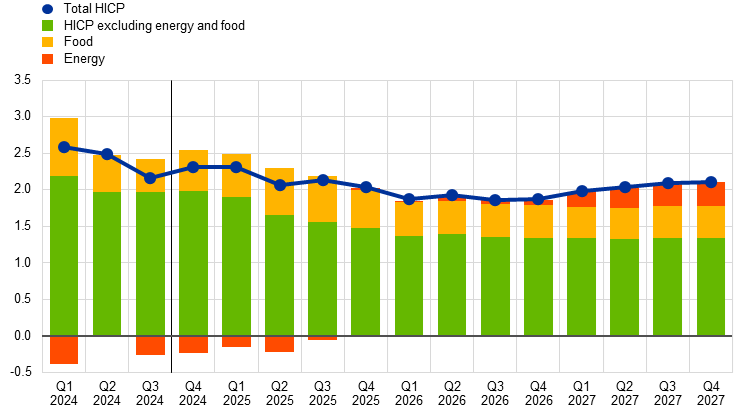

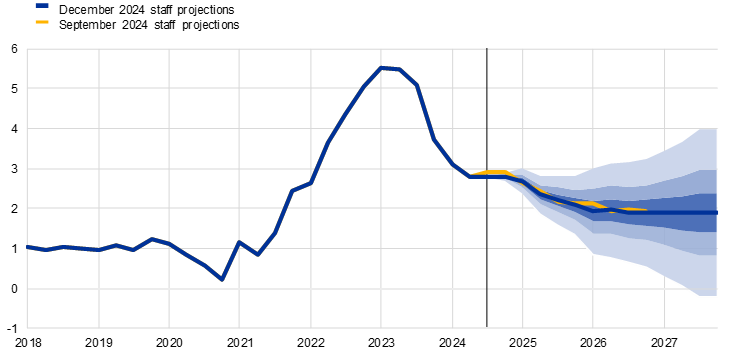

Headline inflation is projected to have edged up again in the last quarter of 2024 and is seen to decline to hover around the ECB’s inflation target of 2% from the second quarter of 2025 (Chart 6 and Chart 7). Headline inflation is expected to rise until the end of the year, mainly owing to base effects in energy prices, before returning to a downward path. HICPX inflation is expected to start to decline in early 2025 and to reach 1.9% in 2027, driven by the services component. Overall, this implies a gradual further decline in headline inflation over the projection horizon, interrupted by a small temporary increase in 2027 as a result of fiscal measures related to the green transition.

Chart 6

Euro area HICP inflation

(annual percentage changes)

Notes: The vertical line indicates the start of the current projection horizon. The ranges shown around the central projections provide a measure of the degree of uncertainty and are symmetric by construction. They are based on past projection errors, after adjustment for outliers. The bands, from darkest to lightest, depict the 30%, 60% and 90% probabilities that the outcome of HICP inflation will fall within the respective intervals. For more information, see the box entitled “Illustrating the uncertainty surrounding the projections” in the March 2023 ECB staff macroeconomic projections for the euro area.

Chart 7

Euro area HICP inflation – decomposition into the main components

(annual percentage changes, percentage point contributions)

Note: The vertical line indicates the start of the current projection horizon.

Energy inflation should remain negative well into 2025 before turning positive again later in the projection horizon. Energy inflation is expected to remain negative until the third quarter of 2025, largely owing to the downward-sloping oil price assumptions, and to return to positive territory thereafter, mainly owing to base effects for fuels (Chart 7). Volatility in energy inflation is anticipated in the first half of 2025, in part owing to the withdrawal of some energy-related fiscal measures.[9] Overall, energy inflation is expected to remain muted, with rates being positive but remaining below historical averages in 2026 and 2027 (Chart 8, panel a). A projected increase in 2027 mainly reflects a largely temporary upward impact from the implementation of the EU Fit for 55 package – specifically a new Emissions Trading System (ETS2) for heating of buildings and for transport fuels (see Box 2 for further details).

Food inflation is expected to increase in 2025 before edging down and moving broadly sideways thereafter (Chart 8, panel b). Food inflation has increased over recent months to stand at 2.9% in October, largely owing to unfavourable weather effects. It is expected to increase to rates around 3.2% by mid-2025, driven at least initially by unprocessed food inflation and assumed substantial increases in commodity prices. It is then projected to decline to an average of 2.2% by 2027, owing to receding energy and labour cost pressures in the medium term, and to make a modest contribution to headline inflation (Chart 7).

Chart 8

Outlook for HICP energy and food inflation

a) HICP energy

(annual percentage changes)

b) HICP food

(annual percentage changes)

Notes: The vertical line indicates the start of the current projection horizon.

Table 5

Price and cost developments for the euro area

(annual percentage changes, revisions in percentage points)

|

December 2024 |

Revisions vs September 2024 |

||||||

|---|---|---|---|---|---|---|---|---|

2023 |

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

|

HICP |

5.4 |

2.4 |

2.1 |

1.9 |

2.1 |

-0.1 |

-0.1 |

0.0 |

HICP excluding energy |

6.3 |

2.9 |

2.5 |

2.0 |

2.0 |

0.0 |

0.1 |

0.0 |

HICP excluding energy and food |

4.9 |

2.9 |

2.3 |

1.9 |

1.9 |

0.0 |

0.0 |

-0.1 |

HICP excluding energy, food and changes in indirect taxes |

5.0 |

2.8 |

2.3 |

1.9 |

1.9 |

0.0 |

0.0 |

-0.1 |

HICP energy |

-2.0 |

-2.3 |

-1.1 |

0.5 |

2.8 |

-0.9 |

-2.2 |

-0.1 |

HICP food |

10.9 |

3.0 |

3.0 |

2.4 |

2.2 |

0.1 |

0.6 |

0.3 |

GDP deflator |

5.9 |

2.9 |

2.4 |

2.1 |

2.1 |

-0.2 |

0.0 |

0.1 |

Import deflator |

-2.5 |

-0.6 |

1.6 |

1.8 |

1.7 |

-0.2 |

-0.1 |

0.0 |

Compensation per employee |

5.4 |

4.6 |

3.3 |

2.9 |

2.8 |

0.1 |

-0.3 |

-0.3 |

Productivity per employee |

-0.9 |

-0.1 |

0.8 |

0.9 |

0.8 |

-0.1 |

-0.1 |

-0.2 |

Unit labour costs |

6.4 |

4.7 |

2.6 |

2.0 |

2.0 |

0.2 |

0.0 |

-0.1 |

Unit profits¹⁾ |

6.5 |

-0.9 |

2.0 |

2.0 |

2.4 |

-1.1 |

0.4 |

0.4 |

Notes: Revisions are calculated using rounded figures. The figures for the GDP and import deflators, unit labour costs, compensation per employee and labour productivity refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications owing to data releases after the cut-off date for the projections. Data are available for downloading, also at quarterly frequency, from the Macroeconomic Projection Database on the ECB’s website.

1) Unit profits are defined as gross operating surplus and mixed income (adjusted for the income of the self-employed) per unit of real GDP.

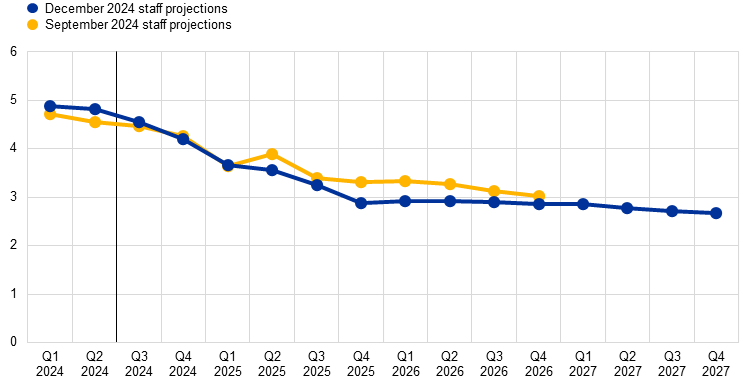

HICPX inflation is expected to decline from 2.9% in 2024 to 1.9% in 2027, mainly owing to a moderate unwinding of services inflation (Chart 9). HICPX inflation has been relatively flat since early 2024, although this conceals some moderation of growth in non-energy industrial goods prices to rates below longer-term averages, while services inflation has been relatively persistent and has essentially moved sideways at rates of around 4% since November 2023. The projected moderation in HICPX inflation from 2025 is due to a gradual decline in services inflation, driven by the continued unwinding of past shocks, and a moderation in labour cost pressures. More generally, the disinflation process related to HICPX inflation reflects a residual downward impact from moderating indirect effects of past energy price shocks and the continued feed-through of the downward impact from the ECB’s monetary policy measures between December 2021 and September 2023. This downward impact is expected to be persistent and to ease only towards the end of the projection horizon.

Chart 9

Euro area HICP inflation excluding energy and food

(annual percentage changes)

Notes: The vertical line indicates the start of the current projection horizon. The ranges shown around the central projections provide a measure of the degree of uncertainty and are symmetric by construction. They are based on past projection errors, after adjustment for outliers. The bands, from darkest to lightest, depict the 30%, 60% and 90% probabilities that the outcome of HICPX inflation will fall within the respective intervals. For more information, see the box entitled “Illustrating the uncertainty surrounding the projections” in the March 2023 ECB staff macroeconomic projections for the euro area.

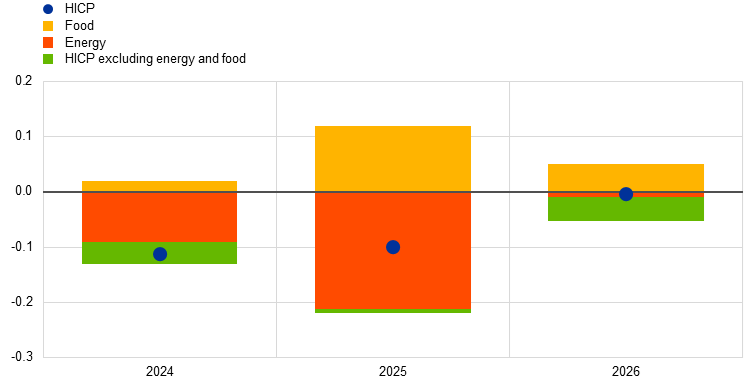

Compared with the September 2024 projections, the outlook for headline HICP inflation has been revised down by 0.1 percentage points for 2024 and 2025 and is unrevised for 2026 (Chart 10). For 2024, a small upward revision to food inflation is more than compensated by a downward revision to energy inflation. A marginal downward revision to HICPX inflation over the whole projection horizon is only visible in the rounded annual average figures for 2026, and initially relates to data surprises in recent months owing to lower than expected services inflation outcomes. Later in the horizon it relates more to the downward revisions to the outlook for economic growth and for wages. The upward revision to food inflation over the whole horizon is mainly due to recent higher than expected outturns and higher food commodity price assumptions. Energy inflation has been revised down for 2024 and 2025 owing to lower than expected outturns and a downward revision to oil and electricity price assumptions, despite somewhat higher gas price assumptions (Box 1).

Chart 10

Revisions to the inflation projection compared with the September 2024 projections

(percentage points)

Note: Revisions are shown based on unrounded data.

Box 2

Assessing the impact of climate change transition policies on growth and inflation

Further policy measures to meet the EU’s targets for reducing greenhouse gas emissions are coming into force in the coming years. This box assesses the impact of changes in national green discretionary fiscal measures on growth and inflation over the projection horizon. A fiscal measure is classified as a green measure if it has a positive impact in terms of climate change prevention or adaptation. In addition, this box looks at the possible impact of the new EU Emissions Trading System 2 (ETS2) on inflation in 2027.

The annual impact of national green discretionary fiscal measures included in the projections baseline is up to -0.1 percentage points for growth, and up to 0.2 percentage points for inflation in the euro area (blue bars in the Chart). Specifically, the dampening impact on GDP growth is expected to increase slightly over the projection horizon, from close to zero in 2024 to around ‑0.1 percentage points in 2026 and 2027. The impact on HICP inflation is expected to be around 0.2 percentage points in 2024 and 2025, declining to 0.1 percentage points in 2026 and then to close to zero in 2027. This impact arises predominantly through measures affecting the energy component, in particular carbon pricing and energy taxes.[10] Overall, the impact of national measures is somewhat larger than estimated in December 2023, but still relatively contained: this is mainly because of a very gradual phasing-in of measures that directly affect prices, such as national carbon pricing.[11]

Chart

Impact of national green discretionary fiscal measures on growth and inflation in the December 2024 projections baseline

a) Real GDP growth |

b) HICP inflation |

|---|---|

(percentage points) |

(percentage points) |

|

|

Over the next three years, in addition to national measures, carbon pricing in the EU will be expanded to cover new sectors, which is likely to affect growth, inflation and public finances (Table). As part of the Fit for 55 package, the existing EU Emissions Trading System 1 (ETS1) will be extended to the aviation, shipping and energy-intensive industries sectors, with a gradual phasing-out of free allowances.[12] Imports into the EU from energy-intensive industries will be subject to a carbon border adjustment mechanism (CBAM). In addition, the EU ETS2 will be introduced in 2027 to cover emissions from building heating and transport fuels: this will likely have the most relevant direct inflationary impact. The measures may also affect inflation indirectly, through import prices and producer prices. To the extent that households are not compensated, such an upward impact on prices may also affect their spending and dampen growth. However, a share of the revenues from the ETS1 and ETS2 is to be invested in energy efficiency and low-carbon technologies, so the net effects on growth are not yet clear.

Table

Key EU carbon price measures

Measure |

Key elements |

|---|---|

EU ETS1 |

In place for electricity, and partially for shipping and aviation. From 2024: start of the phasing-out of free allowances for aviation, increase in the coverage of emissions from shipping From 2026: start of the phasing-out of free allowances for energy-intensive industries |

EU ETS2 |

From 2027: application to emissions from building heating and transport fuels, as well as from small industrial installations |

CBAM |

From 2026: imports from energy-intensive industries will be taxed in accordance with the ETS1 carbon price (unless equivalent taxation exists in the exporting country) |

Source: European Commission.

The carbon price under the ETS2 will likely be passed on to consumers, but there is uncertainty about how high the carbon price will be. Similarly to the ETS1, emission allowances under the ETS2 will be traded and their price will be determined by the market. The price of an ETS2 allowance is not yet known as there is no trading yet. Nonetheless, the ETS Directive[13] provides that if the average price in two consecutive months exceeds a threshold value of €45/tCO2 (per tonne of CO2 emissions in 2020 prices) during the initial years, or if the price increases too rapidly, additional allowances will be released from a market reserve to keep the prices below the threshold. Upstream providers will need to pay for emissions from their products – and it seems likely that they will pass on the costs to the consumer. A direct impact on HICP energy inflation is therefore expected. The size of this impact will depend, among other things, on developments in ETS2 prices. In the absence of any market-based information on a likely price level in 2027, the projections baseline assumes a price level at the threshold (i.e. at €59/tCO2 in expected 2027 prices).[14]

The impact on HICP inflation is uncertain and could range from 0.0 percentage points to 0.4 percentage points in 2027, with a much smaller impact in 2028. In addition to uncertainty regarding the ETS2 price, the speed and extent of the pass-through to consumer prices is not yet clear. While changes in cost pressures for energy products are typically passed on to consumers quickly, a somewhat delayed pass-through could be expected, as: (i) companies only need to surrender ETS2 permits for 2027 in 2028; (ii) in some countries there are lags in the repricing of consumer contracts for gas; and (iii) administered prices and fiscal measures may – initially – dampen the effect.[15] A further element of uncertainty relates to the planned transitions from existing national schemes to the ETS2.[16] Staff estimates, conditional on a range of plausible assumptions relating to the ETS2 price level, the speed and extent of pass-through, and the modalities of the transition to ETS2 in countries with existing national schemes, suggest the impact on HICP inflation in 2027 could be between 0.0 percentage points and 0.4 percentage points, with a much smaller impact in 2028.[17] The impact could be dampened in the event that households strongly and pre-emptively substitute away from fossil fuels and/or if governments adopt mitigating measures. Beyond the ETS2, other measures in the Fit for 55 package (e.g. the introduction of the CBAM) are expected to have only a small impact.

Looking beyond the projection horizon, the ETS2 price may increase further, but such increases may be mitigated by a decline in the share of fossil fuels in the consumption basket. A range of studies in the literature expect much higher prices by 2030 (after the threshold price mechanism has been removed).[18] Prices at the higher end of the estimates are based on the assumption that other, complementary emissions reduction policies (e.g. provisions for increasing energy efficiency or bans on vehicles with combustion engines) will only be partly effective. Such price rises would imply a significant inflationary impetus from these policies after 2029, while the baseline currently assumes that the introduction of ETS2 will lead to temporary effects only in 2027 (and to a small extent also in 2028). In addition, it is likely that prices will be more volatile. Finally, in the longer run the impact on HICP energy inflation of future changes in ETS2 prices may be attenuated by a declining share of, and reduced household expenditure on, fossil fuels in the energy mix.

Nominal wage growth is projected to initially remain elevated but then decline gradually, in part reflecting the catch-up of real wages to the levels prevailing before the inflation surge. Growth in compensation per employee is estimated to have declined to 4.5% in the third quarter of 2024 (in line with the September projections).[19] Wage growth is projected to continue its sustained decline, moderating from an average of 4.6% in 2024 to stand at 2.8% in 2027 (Chart 11). This decline mainly reflects an expected decrease in negotiated wage growth, in part owing to smaller increases in minimum wages, while the contribution of the wage drift should be negligible in 2024, but relatively stable and moderate in the coming years. Following recent revisions to national accounts data, real wages are estimated to have returned in the third quarter of 2024 to levels recorded in early 2022. While this implies lower inflation compensation pressures, labour markets are still tight which helps to explain why wage growth remains elevated compared with the historical average level of 2.3%. Compared with the September 2024 projections, growth in compensation per employee has been revised up by 0.1 percentage points for 2024, owing to data surprises, but has been revised down by 0.3 percentage points for subsequent years in line with the projected lower unemployment rate.

Chart 11

Compensation per employee

(annual percentage points)

Note: The vertical line indicates the start of the current projection horizon.

Growth in unit labour costs is projected to decline in 2025 and 2026, aided by rising productivity and falling wage growth. Unit labour cost growth is estimated to have been 4.5% in the third quarter of 2024 and is expected to fall sharply to an average of 2.0% by 2027.[20] Nevertheless, it will remain above the historical average of 1.8%. Compared with the September 2024 projections, growth in unit labour costs has been revised up by 0.2 percentage points for 2024 and down by 0.1 percentage points for 2026.

Overall, domestic price pressures, as measured by the growth of the GDP deflator, are projected to continue to decrease, with profit margins providing a buffer against labour cost pressures in the short term (Chart 12). The annual growth rate of the GDP deflator is estimated to have fallen rapidly in 2024, averaging 2.9% for the year (after 5.9% in 2023), but it is projected to decline more gradually over the horizon to stand at an average of 2.1% in 2027. Unit profit growth is expected to continue to absorb the relatively strong labour cost growth, but only in the short term.[21] As growth in unit labour costs moderates and other input costs remain contained, profit margin growth is expected to recover somewhat from 2025, aided by the economic recovery and strengthening productivity growth, and thus make a positive contribution to domestic price pressures again from 2025. Compared with the September 2024 projections, GDP deflator growth has been revised slightly down for 2024, remains unchanged for 2025 and has been revised up slightly for 2026. Profit margin growth has been revised slightly down for 2024 and up for 2025 and 2026, largely offsetting the corresponding upward and downward revisions to unit labour cost growth.

Chart 12

Domestic price pressures

a) GDP deflator and its components |

b) GDP deflator and its components – revisions vs the September 2024 projections |

|---|---|

(annual percentage changes, percentage point contributions) |

(percentage point contributions) |

|

|

Note: The vertical line indicates the start of the current projection horizon.

Import price inflation is expected to pick up but remain below 2% throughout the projection horizon. Growth in the import deflator is expected to increase from ‑0.6% in 2024 to 1.6% in 2025, and to 1.7% in 2027. The figures for 2024-25 have been revised down in line with downward revisions to competitors’ export prices and despite the depreciation of the euro implied by the technical assumptions (Box 1).

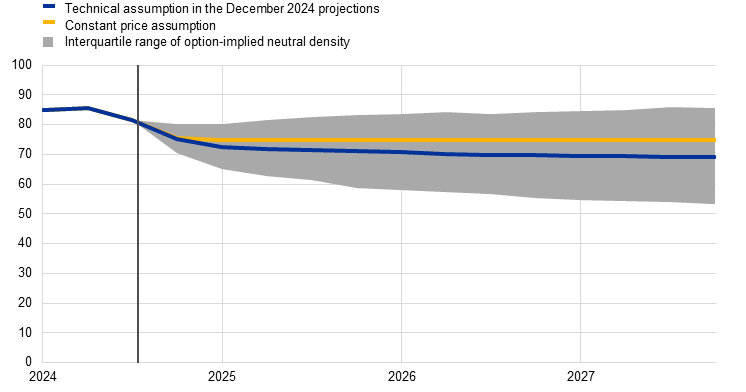

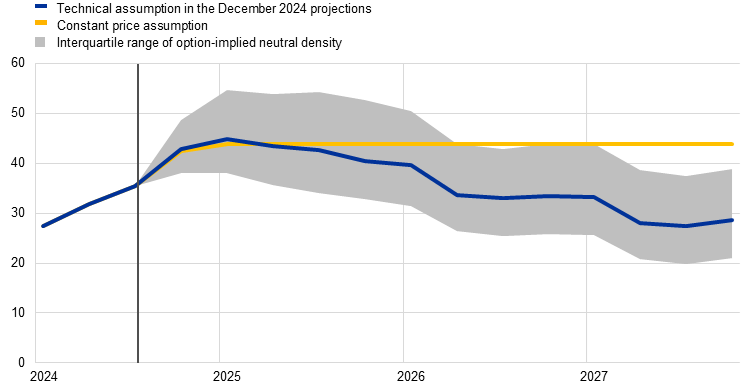

Alternative energy price paths

Future energy commodity price developments remain very uncertain and alternative paths for oil and gas commodity prices would have a significant impact on the economic outlook, especially for inflation. While the staff projections are based on the technical assumptions outlined in Box 1, in this sensitivity analysis alternative downside and upside paths are derived from the 25th and 75th percentiles of the option-implied neutral densities for both oil and gas prices.[22] Alternative paths for oil prices are symmetrically distributed around the baseline, reflecting broadly balanced risks. By contrast, the gas price distribution indicates upside risks to the technical assumptions (Chart 13), likely reflecting supply uncertainties. These uncertainties are associated with the impending expiry of the gas transit agreement between Ukraine and Russia, as well as with recent delays in liquefied natural gas supply projects. A constant price assumption is also considered for both oil and gas prices. In each case, a synthetic energy price index (a weighted average of the oil and gas price paths) is computed, and the impacts are assessed using ECB and Eurosystem macroeconomic models. The results are shown in Table 6.

Chart 13

Alternative paths for energy price assumptions

a) Oil price assumption

(USD/barrel)

b) Gas price assumption

(EUR/MWh)

Sources: Morningstar and ECB calculations.

Note: Option-implied densities for gas and oil prices are extracted from 20 November 2024 market quotes for options on ICE Brent crude oil and Dutch TTF natural gas futures with fixed quarterly expiry dates.

Table 6

Alternative energy price paths and the impact on real GDP growth and HICP inflation

Path 1: 25th percentile |

Path 2: 75th percentile |

Path 3: constant prices |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

2027 |

|

(deviations from baseline levels, percentages) | ||||||||||||

Oil prices |

-1.3 |

-13.7 |

-19.0 |

-21.9 |

1.6 |

14.0 |

19.6 |

23.1 |

0.1 |

4.2 |

6.7 |

8.1 |

Gas prices |

-3.5 |

-18.0 |

-22.0 |

-25.6 |

4.2 |

25.6 |

29.4 |

35.3 |

-0.2 |

2.1 |

25.2 |

49.1 |

Synthetic energy price index |

-2.4 |

-15.9 |

-19.3 |

-21.9 |

3.0 |

21.9 |

25.1 |

27.2 |

0.0 |

3.0 |

13.3 |

21.5 |

(deviations from baseline growth rates, percentage points) | ||||||||||||

Real GDP growth |

0.0 |

0.1 |

0.1 |

0.0 |

0.0 |

-0.1 |

-0.1 |

-0.1 |

0.0 |

0.0 |

-0.1 |

-0.1 |

HICP inflation |

0.0 |

-0.6 |

-0.5 |

-0.3 |

0.1 |

0.7 |

0.6 |

0.3 |

0.0 |

0.2 |

0.4 |

0.4 |

Notes: In this sensitivity analysis, a synthetic energy price index that combines oil and gas futures prices is used. The 25th and 75th percentiles refer to the option-implied neutral densities for oil and gas prices on 20 November 2024. The constant oil and gas prices take the respective value as at the same date. The macroeconomic impacts are reported as averages of a number of ECB and Eurosystem staff macroeconomic models.

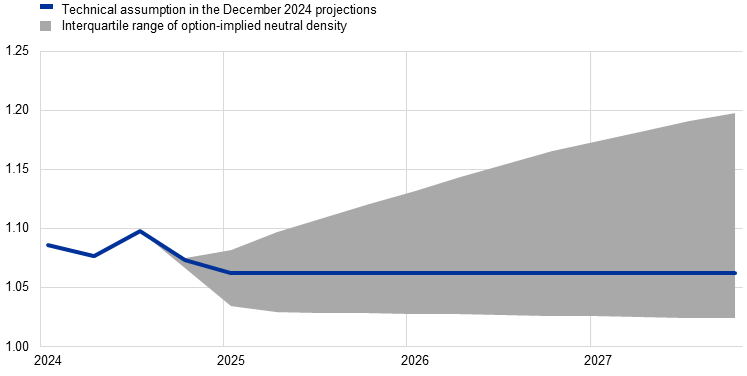

Alternative exchange rate paths

This sensitivity analysis assesses implications for the baseline projections of alternative paths for the exchange rate. The technical assumptions for exchange rates in the projections baseline are held constant over the projection horizon. Alternative downside and upside paths are derived from the 25th and 75th percentiles of option-implied neutral densities for the USD/EUR exchange rate on 20 November 2024 (Chart 14). The impacts of these alternative paths are assessed using ECB and Eurosystem macroeconomic models. The average impact on output growth and inflation across these models is shown in Table 7.

Chart 14

Alternative paths for the USD/EUR exchange rate

Sources: Bloomberg and ECB staff calculations.

Notes: An increase implies an appreciation of the euro. The 25th and 75th percentiles refer to the option-implied neutral densities for the USD/EUR exchange rate on 20 November 2024. The macroeconomic impacts are reported as averages of a number of ECB and Eurosystem staff macroeconomic models.

Table 7

Impact on real GDP growth and HICP inflation

Path 1: 25th percentile |

Path 2: 75th percentile |

|||||||

|---|---|---|---|---|---|---|---|---|

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

2027 |

|

USD/EUR exchange rate |

1.08 |

1.03 |

1.03 |

1.03 |

1.08 |

1.10 |

1.15 |

1.19 |

USD/EUR exchange rate |

-0.2 |

-3.0 |

-3.3 |

-3.5 |

0.0 |

3.7 |

8.1 |

11.7 |

(deviations from baseline growth rates, percentage points) | ||||||||

Real GDP growth |

0.0 |

0.1 |

0.1 |

0.1 |

0.0 |

-0.1 |

-0.2 |

-0.3 |

HICP inflation |

0.0 |

0.1 |

0.1 |

0.1 |

0.0 |

-0.1 |

-0.3 |

-0.3 |

Sources: Bloomberg and ECB staff calculations.

Notes: An increase implies an appreciation of the euro. The 25th and 75th percentiles refer to the option-implied neutral densities for the USD/EUR exchange rate on 20 November 2024. The macroeconomic impacts are reported as averages of a number of ECB and Eurosystem staff macroeconomic models.

Box 3

Comparison with forecasts by other institutions and the private sector

The December 2024 Eurosystem staff projections are generally within the range of other forecasts for GDP and HICP inflation. The staff projection for growth is within the range of forecasts from other institutions and surveys of private sector forecasters throughout the horizon. As regards HICP inflation, for 2025 the Eurosystem staff projection lies at the top of the range. For 2026, the Eurosystem staff projection is within a narrow range of other forecasters and for 2027 it is slightly above the other forecasts available. This could be due to differences in the assessment of the impact of the EU Emissions Trading System 2 (ETS2) scheme (see Box 2). The Eurosystem staff projection for HICPX inflation is aligned with other forecasts but slightly lower for 2027.

Table

Comparison of recent forecasts for euro area real GDP growth, HICP inflation and HICP inflation excluding energy and food

(annual percentage changes)

|

Date of release |

GDP growth |

HICP inflation |

HICP inflation excl. energy and food |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

2027 |

2024 |

2025 |

2026 |

2027 |

||

Eurosystem staff projections |

December 2024 |

0.7 |

1.1 |

1.4 |

1.3 |

2.4 |

2.1 |

1.9 |

2.1 |

2.9 |

2.3 |

1.9 |

1.9 |

OECD |

December 2024 |

0.8 |

1.3 |

1.5 |

- |

2.4 |

2.1 |

2.0 |

- |

2.9 |

2.4 |

2.0 |

- |

European Commission |

November 2024 |

0.8 |

1.3 |

1.6 |

- |

2.4 |

2.1 |

1.9 |

- |

2.9 |

2.4 |

2.0 |

- |

Consensus Economics |

November 2024 |

0.8 |

1.1 |

1.4 |

1.4 |

2.4 |

1.9 |

1.9 |

1.9 |

2.8 |

2.2 |

- |

- |

Survey of Professional Forecasters |

October 2024 |

0.7 |

1.2 |

1.4 |

- |

2.4 |

1.9 |

1.9 |

- |

2.8 |

2.2 |

2.0 |

- |

International Monetary Fund |

October 2024 |

0.8 |

1.2 |

1.5 |

1.4 |

2.4 |

2.0 |

2.0 |

1.9 |

- |

- |

- |

- |

Sources: OECD Economic Outlook, published on 4 December 2024, cut-off date 27 November 2024; Consensus Economics Forecasts, 14 November 2024 for 2024-25 (data for 2026-27 are taken from the October 2024 survey); ECB Survey of Professional Forecasters, published on 21 October 2024; IMF World Economic Outlook, cut-off date 22 October 2024; European Commission Autumn 2024 Economic Forecast, cut-off date 21 October 2024.

Notes: These forecasts are not directly comparable with one another or with the Eurosystem staff macroeconomic projections, as they were finalised at different points in time. Additionally, they use different methods to derive assumptions for fiscal, financial and external variables, including oil, gas and other commodity prices. The Eurosystem staff macroeconomic projections report working day-adjusted annual growth rates for real GDP, whereas the European Commission and the International Monetary Fund report annual growth rates that are not adjusted for the number of working days per annum. Other forecasts do not specify whether they report working day-adjusted or non-working day-adjusted data.

© European Central Bank, 2024

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISBN 978-92-899-6612-2, ISSN 2529-4687, doi:10.2866/286592, QB-CF-24-002-EN-N

HTML ISBN 978-92-899-6591-0, ISSN 2529-4687, doi:10.2866/04939, QB-CF-24-002-EN-Q

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release