Analysts say the new tariffs suggest that the renewal of the initiative is extremely unlikely

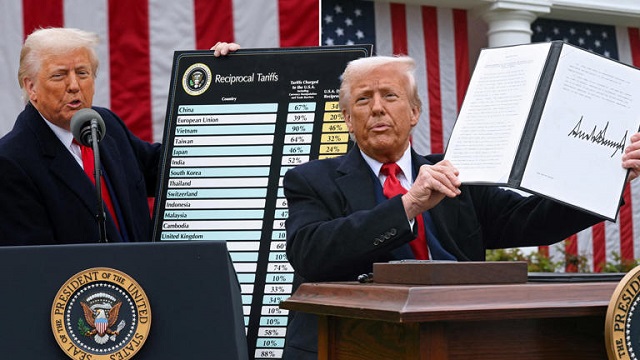

COVER STORY | THE INDEPENDENT & AGENCIES | In what has been described as one of the most disruptive moments in trade history, U.S. President Donald Trump on April 02 unleashed sweeping tariffs on nearly all imports in his country.

At a blustery Rose Garden event, Trump unveiled a 10% across-the-board tariff on all imports, alongside targeted tariffs of 34% on Chinese goods, 20% on European products, 24% on Japan, and 10% on the UK.

In Africa, the move appears to signal the end of the AGOA (African Growth and Opportunity Act) trade deal that was supposed to help African economies develop through preferential access to U.S. markets, trade experts said, according to a Reuters report.

A 50% reciprocal trade tariff on Lesotho, is the highest levy on Trump’s long list of target economies. It has a large trade surplus with the United States, mostly made up of diamonds and textiles, including Levi’s jeans.

In recent years, Lesotho has been successful in selling textiles to the US, making the most of the African Growth and Opportunity Act (Agoa). Its exports to the United States, which in 2024 totaled $237 million, account for more than 10% of its GDP.

Trump said the “reciprocal” tariffs were a response to duties and other non-tariff barriers put on U.S. goods. Lesotho charges 99% tariffs on American goods, according to the U.S. administration.

Other African countries hit with extra tariffs include 47% for Madagascar, 40% for Mauritius, 37% for Botswana and 30% for South Africa. Nigerian exports will be hit too – at a rate of 14%.

Kenya, Ghana, Ethiopia, Tanzania, Uganda, Senegal and Liberia were among those countries whose exports to the US will be subject to the baseline tariff of 10%. The US is not running a trade deficit with these countries.

Analysts say the new tariffs suggest that the renewal of the initiative, known as the African Growth and Opportunity Act (AGOA), is extremely unlikely.

AGOA is a U.S. trade initiative passed in 2000 under former President Bill Clinton to deepen trade ties with Sub-Saharan Africa and help African countries develop their economies.

It provides duty-free access to the U.S. market for thousands of products including motor vehicles and parts, textiles and clothing, minerals and metals, agricultural products and chemicals exported by eligible African countries.

It has been renewed twice and is due to expire in September 2025.

African countries have been pushing for a 10-year extension, but economists say that the Trump administration’s protectionist trade policies mean AGOA’s renewal is unlikely.

The new tariffs have heightened the risk that AGOA may be scrapped altogether even before it expires, unless the region presents strong bargaining chips to keep it in place, analysts say.

Government officials from South Africa and Madagascar said they were waiting for clarity on whether the reciprocal tariffs announced by Trump will be applied to goods that are exported under AGOA.

AGOA’s extension requires a decision of the U.S. Congress and is thereafter signed into law by the U.S. President.

About 35 African countries are currently eligible. Countries can lose and regain eligibility based on criteria including economic policies and protection of human rights.

Countries that have used AGOA to boost trade

A number of countries including South Africa, Nigeria, Ghana, Kenya, Lesotho, Madagascar and Ethiopia have successfully used AGOA to boost exports to the U.S., drive industrialization and create jobs, especially in textiles, automotives and minerals including crude oil.

The United States benefits by furthering its interests on the continent. It also gains access to critical minerals and investment opportunities.

Countries that undermine U.S. national security or foreign policy interests are not eligible for AGOA.U.S. lawmakers view it as an important soft power tool, particularly as a counter to Chinese influence.

Sectors such as South Africa’s automotive industry as well as Kenya and Lesotho’s clothing sectors would be hit hardest from a sudden rise in tariffs or non-renewal of AGOA.

Many analysts have said that AGOA is under-utilised. Only about half of eligible countries have developed national AGOA utilisation strategies, and the majority of exports come from just a few of them.

While the apparel sector and automotive industry have been the programme’s biggest success stories, other industries have lagged.

U.S. imports from AGOA beneficiaries peaked in 2008 at $82 billion and had fallen to $29.1 billion in 2024, according to the AGOA website.

Some analysts say AGOA has had a positive impact but that it needs to be updated and improved to include newer industries such as technology and digital services.

Globally, stocks slumped as markets continued to react to the uncertainty triggered by the US tariffs and the retaliatory taxes imposed by big economies such as China. On April 04 China imposed additional tariffs of 34% on all US goods from 10 April. But countries with smaller economies were having to be more cautious.

In London, shares in Barclays bank and NatWest were down more than 8%, mining firm Glencore fell more than 9% and aero-engine maker Rolls-Royce was down more than 9%.

Investors also went on a buying spree of safe haven assets including gold and government bonds. Gold was above $3,121 an ounce on April 04, back near record highs, while bond yields were down, according to Trading Economics.

Oil prices fell

Oil prices fell sharply as traders worried that the tariffs could slow economic growth and worsen trade disputes. The price of a barrel of Brent crude slumped more than 6% to $65.35 a barrel.

The managing director of the International Monetary Fund (IMF), Kristalina Georgieva, said the new tariffs “clearly represent a significant risk to the global outlook at a time of sluggish growth”.

She said the IMF was still looking into the “macroeconomic implications” of the measures and stressed the need to avoid actions that could do more damage to the global economy.

Global financial analysts say President Trump detonated the foundation of modern global commerce by announcing the sweeping tariffs.

Nigel Green, CEO of global financial advisory giant deVere Group, said Trump “peddles in economic delusion” and risks triggering a dangerous global slowdown. deVere Group is one of the world’s largest independent advisors of specialist global financial solutions to international, local mass affluent, and high-net-worth clients. It has a network of offices around the world, more than 80,000 clients, and $14bn under advisement.

“This is how you sabotage the world’s economic engine while claiming to supercharge it,” said Nigel Green.

“It’s a seismic day for global trade. Trump is blowing up the post-war system that made the U.S. and the world more prosperous, and he’s doing it with reckless confidence.”

Declaring April 2nd as “Liberation Day” for American trade, Trump said the new policy would “make America wealthy again.”

But economists and markets are sounding the alarm.

“Tariffs are taxes—plain and simple—and American consumers will bear the brunt,” notes the deVere Group chief executive.

The reality is stark: these tariffs will push prices higher on thousands of everyday goods—from phones to food—and that will fuel inflation at a time when it is already uncomfortably persistent.

The OECD recently warned that if the U.S. and its trading partners raise tariffs by 10 percentage points, global GDP could fall by 0.3% within three years, while inflation could rise by an average of 0.4 percentage points each year over the same period.

“This plan can be expected to directly increase the cost of living in the U.S.,” explains Nigel Green. “Wages won’t keep up with price hikes, and the squeeze on households will likely be intense.”

Confidence, investment, and growth are already under threat.

Even before the shock announcement, the threat of protectionism had begun to drag down global sentiment. Now, that uncertainty is hardening into reality.

“When businesses don’t know what trade will look like next quarter, they stop hiring, stop investing, and freeze plans. That ripples through to consumers. This chilling effect is how recessions begin,” warns the global business leader.

Borrowing costs surged

Global borrowing costs are climbing in the wake of trade disruption.

The announcement also stoked fears in bond markets. Governments already struggling under pandemic-era debt are facing higher borrowing costs as yields rise in response to the uncertainty and inflation threat.

“This is a body blow to fragile fiscal frameworks,” Nigel Green affirms. “For nations still recovering from years of shocks—financial, pandemic, geopolitical—Trump’s trade war is a major setback.”

He continued: “The dollar’s dominance is also no longer a sure thing. America’s credibility is on the line. With the dollar as the global reserve currency, any whiff of unpredictability or politicized policy makes global investors nervous. That trust is hard-earned and easily lost.”

The deVere CEO noted that while Trump is presenting his move as a patriotic correction to trade imbalances, the actual result could be long-lasting damage to America’s economic leadership.

Back peddling is “inevitable”, predicts the chief executive.

“Economic gravity will kick in. As the costs become clear and the political pain sets in, we expect a backpedal and or reversal of many tariffs within 12 months. The markets, the public, and eventually even the policymakers won’t accept these self-inflicted wounds,” he said.

For now, the world must reckon with the fallout from what “may become one of the most disruptive moments in trade history.”

Nigel Green concludes: “It would appear that Trump is peddling in economic delusion. But the global economy runs on reality—and the reality is that this will likely cause harm on a scale that can’t be spun away.”

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price