The International Monetary Fund, in its recent Article IV Consultation for India, has identified several risks to India’s economic growth outlook, including geo-political fragmentation, oil price volatility, and weaker-than-expected recovery in both private consumption and investment.

While the IMF welcomed India’s shift towards using the debt-to-GDP ratio as a medium-term fiscal anchor, it recommended specific improvements to this framework, alongside a proposed revamping of the Fiscal Responsibility and Budget Management (FRBM) Act.

The Fund advocates greater exchange rate flexibility, and makes some notable recommendations on furthering reforms in the financial sector and the labour market.

Shift towards debt-based anchor & need for revamped fiscal legislation

The IMF commended India’s focus on fiscal consolidation. It noted that the shift towards a debt-based anchor is a positive step towards improving accountability and transparency in the fiscal framework.

In the budget for 2025-26, the central government has detailed the shift towards debt-GDP ratio as the fiscal anchor from 2026-27 financial year. It has targeted lowering the debt-GDP ratio to 50±1 percent by 31 March, 2031. The debt-GDP ratio for the central government is estimated to be 57.1 percent in 2024-25 and 56.1 percent in 2025-26.

The IMF has suggested that the debt anchor should incorporate states’ debt as well to ensure greater commitment to debt reduction at the general government debt level. It opines that while the prime focus is on reducing debt-GDP ratio, it would be useful to provide the fiscal deficit glide path for both central and state governments. This could serve as operational guidance for their respective budgets.

The Fund also recommends including medium-term projections of key macroeconomic variables to further enhance transparency. All these elements, the Fund opines, should form part of the revamped FRBM Act.

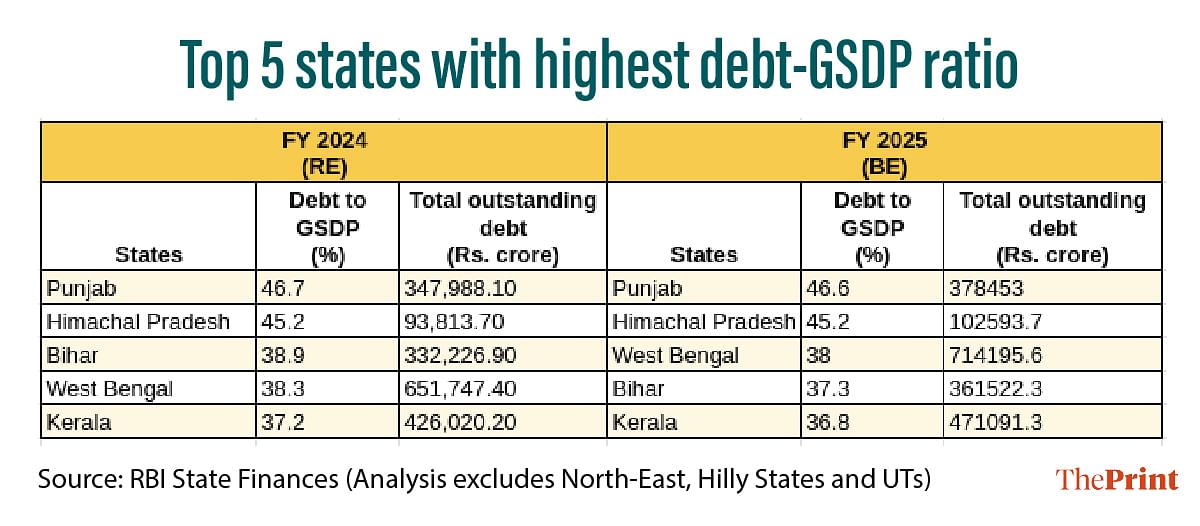

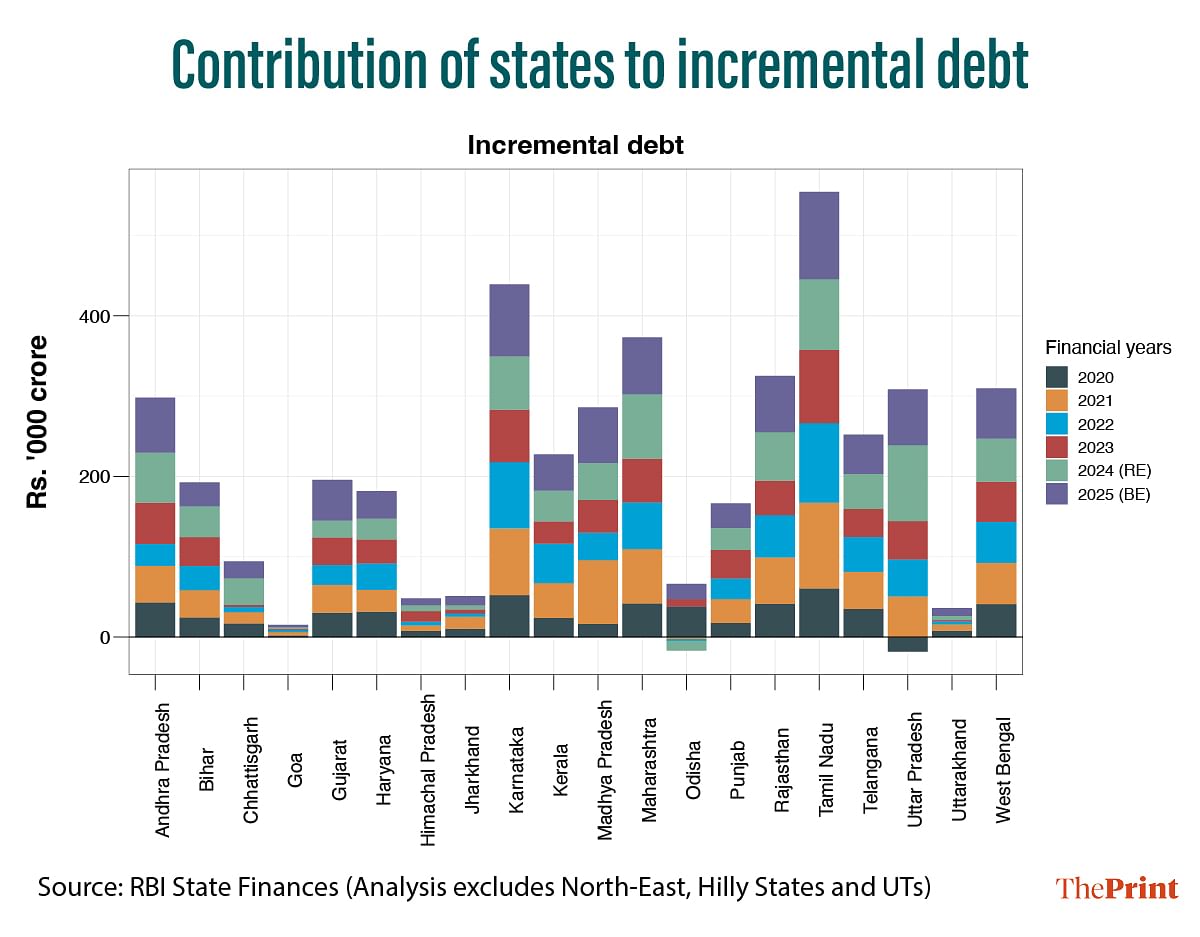

The suggestion to include state government finances in the revised framework should be given due consideration. States differ markedly with respect to their debt burdens. Punjab, Himachal Pradesh, Bihar, West Bengal and Kerala are some of the states with elevated debt-GDP ratios. On the other end of the spectrum are Odisha, Maharashtra and Gujarat, whose debt-GDP ratios are below 20 percent.

Articulation of debt reduction roadmap for both Centre and states would enhance the appeal of the new debt-based fiscal framework.

Also Read: The difference a few months can make. From a strong economic outlook, US now staring at a slowdown

Greater foreign exchange rate flexibility

The IMF advocated greater exchange rate flexibility, allowing the currency to adjust to external shocks while maintaining price stability. Foreign exchange market intervention should be limited to addressing disorderly market conditions. The Fund makes a case for exchange rate flexibility as it reduces moral hazard by encouraging firms to actively hedge their foreign currency exposure, and curtail volatility in domestic market liquidity.

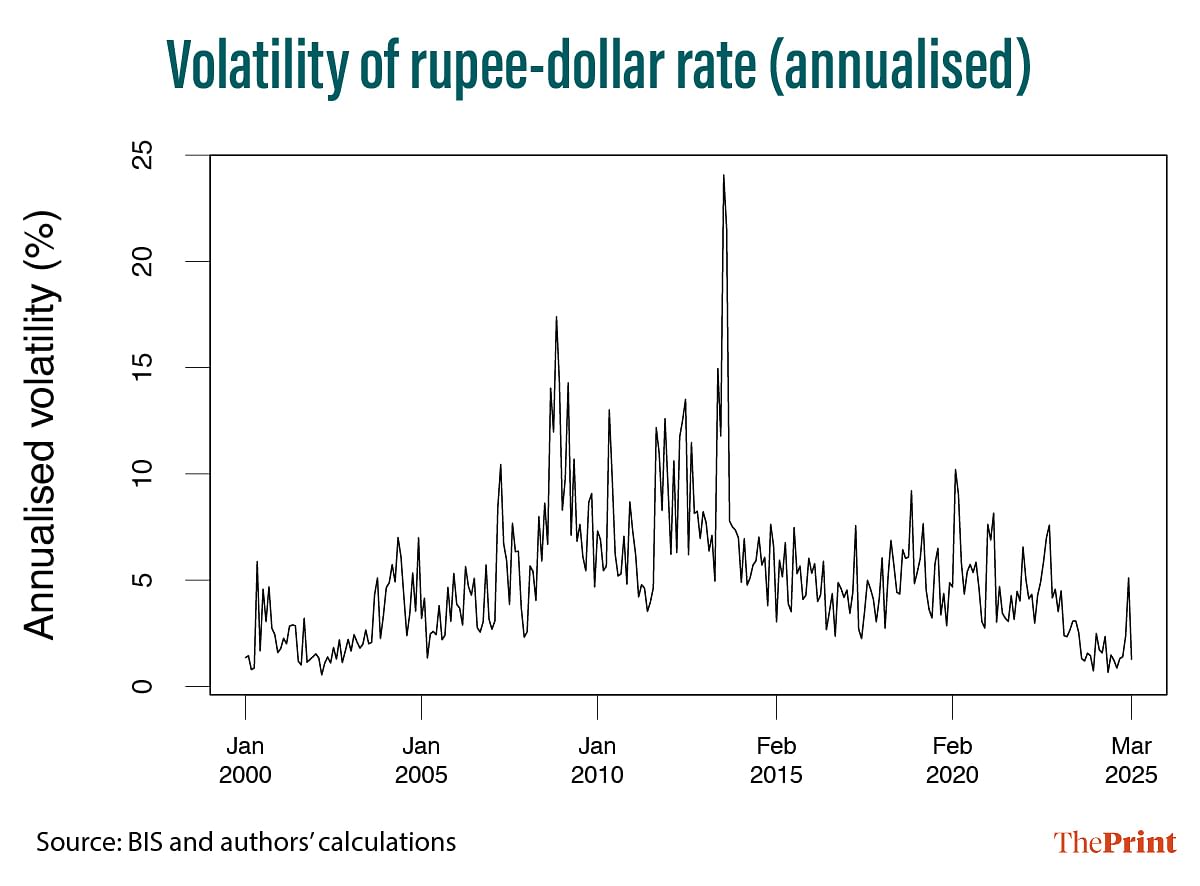

This recommendation is noteworthy as in the past two years, the RBI has been actively intervening in the currency spot and forward market to keep the rupee stable. With sustained intervention, the Reserve Bank of India has been able to achieve a substantial reduction in the average annual volatility of the rupee-dollar rate.

From 2000 to 2022, the average annual volatility of the rupee dollar rate was around five percent. In contrast, in 2023 and 2024, and up to 11 March, 2025, the average annual volatility has fallen to 1.92 percent. This is even lower than the volatility in the early 2000s, when the rupee was effectively pegged to the dollar.

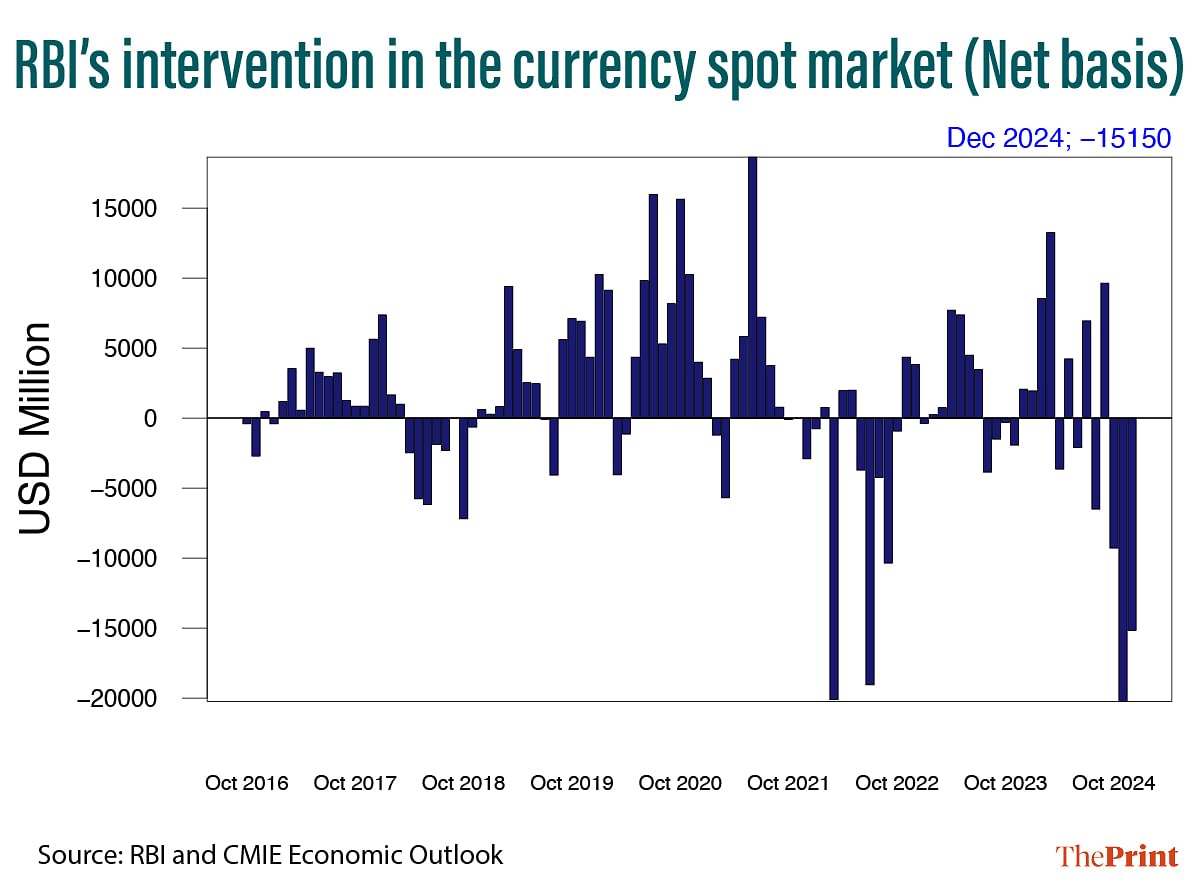

The fall in volatility is primarily the result of the RBI’s massive interventions on both sides of the FX market—buying dollars to prevent the rupee from appreciating and selling dollars to prevent the rupee from depreciating.

In November 2024, the RBI did a net sale of USD 20.23 billion in the spot market. This was one of the highest pace of monthly interventions. In December, the RBI net sold USD 15.15 billion in the spot market. It has also built up a huge short position in the offshore non-deliverable forward market. By December 2024, the outstanding short position had surged to USD 67.93 billion.

The RBI’s continued dollar sales to prevent rupee depreciation is also one of the key reasons for liquidity tightness in the banking system.

The central bank’s active management of currency volatility has another unintended consequence—unhedged currency exposure. Recent data from RBI’s Financial Stability Report shows that around 34.4 percent of External Commercial Borrowings (ECBs), amounting to USD 65.49 billion, remain unhedged. This raises concerns on the relation between RBI’s currency policy and risk management strategy.

Resilient financial system & better quality job creation

The IMF has made some noteworthy recommendations towards furthering the reform agenda in the financial system. To begin with, the Fund has recommended a reduction in the Statutory Liquidity Ratio (SLR). In every country, financial regulators can frame regulations, requiring financial firms to invest a part of their balance sheet in government bonds. When these ratios attain higher values, they create a financial repression system.

In India, the financial repression eased with a reduction in SLR from 38.5 percent in early nineties to 18 percent in 2020. But since April 2020, the ratio has been left unchanged. There is scope for reducing this ratio further to make room for greater voluntary participation in the government bond market.

Second, the Fund has recommended improvements in the Priority Sector Lending model (PSL). Multiple expert committees have also noted that PSL policy design has prevented banks from pursuing unique business strategies and developing business models focused on lending to specific priority sectors. They have proposed various designs for making the PSL more flexible. While some progress has been made, it is still an unfinished agenda of financial sector reforms.

The Fund stressed the need for a law on financial resolution regime with tools and powers in line with international standards. At present, the powers and responsibilities of resolving troubled financial firms are limited and scattered across multiple laws.

The Financial Resolution and Deposit Insurance (FRDI) Bill proposed to establish a Resolution Corporation, and a comprehensive resolution regime to enable timely and orderly resolution of a failing financial firm. However, the bill was shelved in August 2018, following apprehensions around the “bail-in” clause by depositors and stakeholders.

The bill should be re-considered after addressing specific concerns around some resolution tools. It could be an important reform towards building a resilient financial system.

On the jobs front, lifting the female labour force participation and reducing obstacles to female employment can help in reducing inequality in the labour market and foster job creation.

Radhika Pandey is an associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Big GDP data revisions can impact policy-making. Method behind advance estimates needs improvement